Black Friday, Cyber Monday and Holiday iPhone Sales

Black Friday has been around for a very long time. Many retailers barely break even or even lose money the rest of the year and wait for the holiday shopping season to get out of the “red” and into the “black”, hence the name. The story goes that finally, the day after Thanksgiving, holiday shopping makes them profitable.

Of course, as a start-up Amazon didn’t make money for the whole year for many years, but that’s another story. Black Friday predates e-commerce and online shopping, so actual, physical “doorbuster” items and occasional melees defined that vaunted retail day.

Cyber Monday originated in the early days of online shopping. Online retailers tried to claim their share of holiday sales, when Black Friday remained a seminal in-person experience. In those early days, before ubiquitous high-speed Internet, the theory was that office workers would use their fast work computers to shop on the Monday after Thanksgiving. Of course, online shopping is no longer exotic, and online shoppers now have fast, easy access to online retailers - on their phones, tablets, and personal computers.

So what does all this mean for iPhone sales at holiday time? Let’s look at in-person and online sales of iPhones in the holiday quarter.

Right away, we note some complicating factors. The December quarter is not only the holiday shopping quarter, but (not coincidentally) is the first full quarter of sales of new iPhone models introduced in September. Also, CIRP data does not distinguish Black Friday or Cyber Monday shopping from other in-store and online shopping during the quarter. We can, though, draw some broad and interesting observations about the December quarter.

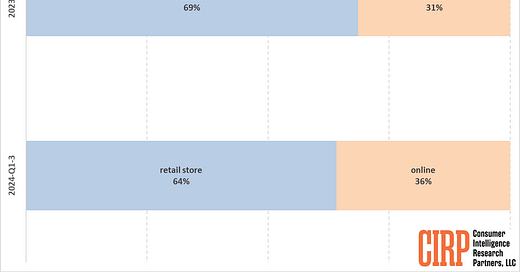

Here, we look at the December 2023 quarter compared to the first three calendar quarters of 2024. CIRP asks survey subjects where they bought their new iPhone: which retailer and whether they bought it at a physical store or ordered it online. As always, we also look only at US sales.

We find the percentage of in-person purchases rises and the percentage of online sales decreases by 5% in the December quarter, compared to the other three quarters of the year (Chart 1).