iPhone 16 Model Sales Suggest More Thrifty Buyers

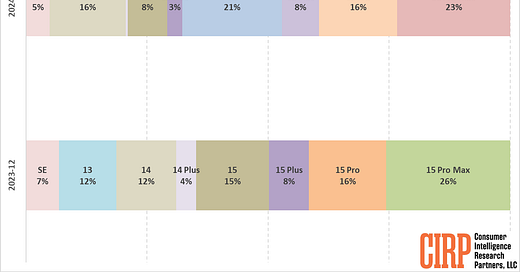

The CIRP team loves the Apple customer survey data for the December quarter. It provides visibility into the first full quarter of availability of iPhone models introduced in September. And the comparison of the quarter to the year-ago quarter is greatly simplified, with “only” twelve iPhone models in the chart.

Based on the December 2024 quarter, combined, the new iPhone 16 models are roughly as popular as new models launched in previous years. Yet, there is movement in the mix of models that is cause for caution or even pessimism about the sales performance of this generation of iPhones.

Apple introduced its new iPhone 16 models in early September for sales starting September 20, 2024. They include the base iPhone 16 and larger iPhone 16 Plus, and premium iPhone 16 Pro and its larger partner, iPhone 16 Pro Max. Sales this quarter includes the new models, and the legacy iPhone 15 and 15 Plus, iPhone 14, and iPhone SE.

In the December 2024 quarter, the new iPhone 16 models combined for a 68% share of total US iPhone sales, slightly ahead of the 65% share for the then-new iPhone 15 models in December 2023 (Chart 1). Combined share for the two iPhone Pro models was down, however.